Category: Real Estate

Focus: Residential & Commercial Property Markets

Audience: Investors, Homebuyers, Developers, Brokers

Introduction: Why Everyone Is Talking About Real Estate Again

So the real estate industry just delivered momentum that many thought was running out of steam. Across major markets globally — particularly in India and the U.S. — transaction traction and price dynamics have shifted direction, and people are starting to get excited and speculate in the real estate community. Prices in some urban corridors have risen, while luxury properties have smashed records; all signs that interest is returning. But what exactly triggered this rebound?

Is this renewed demand going to drive the property market toward sustained growth through 2026?

And what are the next things to watch for by homebuyers, investors, developers, and lenders who’ve been on the sidelines?

Let’s break it all down.

Market Snapshot: What Actually Happened on the Ground

This wasn’t just a seasonal bounce. Across regions, the story was nuanced:

In the United States, official data shows U.S. home prices rose at the slowest annual rate since 2012, with only a 1.7% increase year-over-year in October 2025, indicating price moderation and improving affordability for buyers — a major psychological shift from the rapid gains seen earlier in the decade. Reuters

At the same time, in India — where the sector remains a critical economic pillar — reports from Grant Thornton highlight that overall residential sales maintained momentum through FY2024–25, though performance varied by segment and city. Grant Thornton Bharat

Within this backdrop, premium and luxury property deals in the U.S. shattered records in 2025 — with multiple transactions north of $100 million — suggesting affluent investor demand remains very strong even while broader volume remains cautious. Wall Street Journal

Here’s what jumped out:

- India’s overall residential market sustained momentum with shifting segment trends. Grant Thornton Bharat

- U.S. prices growing at the slowest pace in more than a decade signals renewed buyer opportunities. Reuters

- Luxury-level transactions hit all-time highs despite a broader market cool-down. Wall Street Journal

So the realistic question remains — why now?

Source: Grant Thornton India Real Estate Report FY 2025–26; market outlook supported by a Reuters poll indicating steady home price growth and sustained demand in key urban markets.

Key Drivers Behind the Real Estate Industry Recover

The recent shift didn’t occur in isolation. Let’s unpack the bigger forces.

1. Confidence from Interest Rate Stability and Affordability Shifts

Interest rate expectations significantly influence real estate psychology. In the U.S., housing price increases slowed to just 1.7% in October 2025, the lowest in years according to Federal Housing Finance Agency data — a sign that affordability constraints are easing for buyers who had been frozen out during rapid inflationary price phases. Reuters

“With home prices settling and borrowing costs crystallizing, we’re seeing a clearer runway for long-term buyers to step back into the market,” says Jason Waugh, President of Coldwell Banker — citing the 2025 American Dream Report. New York Post

This matters because buyers respond to predictability — and when prices moderate and interest rates stabilize, confidence returns.

2. Regional Variations Reveal Growth Pockets

Think about it — real estate isn’t uniform. Some regions are cooling, others are booming:

- In India, **Chennai’s housing market posted a 15% sales increase in 2025, bucking national slowdown trends thanks to affordability and strong mid-income demand. The Times of India

- In contrast, Pune saw new home sales fall by about 20%, driven by economic headwinds like IT layoffs and tariff pressures. The Times of India

- Even smaller markets like Thiruvananthapuram (TVM) led tier-2 city growth with a 19% surge in residential sales, reflecting localized demand drivers like sector employment and infrastructure expansion. The Times of India

“Different cities are outperforming based on local employment, affordability, and infrastructure investment — it’s not one single national trend,” says analysts at ANAROCK Group.

Regional diversity means investors and developers must apply tailored strategies rather than blanket expectations.

For a detailed look at how the Mohali real estate market is expected to perform through 2026, including price trends and demand patterns, explore our in-depth Mohali real estate forecast here:

3. Premium & Luxury Demand Remains Robust

While broad residential volumes lag in some markets, luxury segments have demonstrated resilience. In the U.S., ultra-luxury real estate closed some of the largest single-property deals in history in 2025 — a clear signal that high-net-worth buyers view real estate as a hedge and store of value even when broader markets cool. Wall Street Journal

Knight Frank and IBEF data also show luxury housing demand rising strongly in India, with higher-end segments growing nearly 28% YoY across major cities — underlining that premium buyer appetite remains significant. India Brand Equity Foundation

Outlook: What Comes Next for the Property Market?

Let’s be real: global real estate is shaped by macroeconomic shifts, demand–supply imbalances, and regional economic performance.

Market Positioning (Technical View)

Across major Indian cities, prices maintained upward momentum through mid-2025, with year-over-year gains generally ranging from 6% to 16%, reflecting healthy long-term demand but unequal regional strength. JLL

If such fundamentals hold and inventory remains balanced without heavy discounting, the recovery stays intact. But watch for local policy changes and credit conditions — those can flip direction quickly.

Sentiment & Market Signals

Market confidence indicators — including buyer intent surveys and absorption rates — are improving in many cities. In the U.S., while overall volumes remain restrained, buyer interest is rising on improved affordability conditions. Reuters

That uptick in sentiment often precedes broader market activity, especially among first-time and move-up buyers.

Real estate market activity across residential, commercial, and investment segments as the industry shows renewed momentum.

Why Real Estate Is About More Than Prices

Real estate moves entire ecosystems — from construction and labor to finance and materials. When this industry stabilizes, it supports jobs, consumer spending, and local economic confidence. That’s why policymakers pay close attention.

Beyond pricing, trends like sustainability features (e.g., energy-efficient homes) rose sharply, with listing mentions increasing by up to 289%, signaling buyer priorities shifting toward long-term value and quality of life. Better Homes & Gardens

Real Estate vs Other Investments: Can It Outperform?

Across cycles, real estate has traditionally delivered balanced risk–reward relative to equities and bonds. Price stability in select markets — plus long-term rental demand — reinforces why many investors prefer real estate as part of diversified portfolios.

With luxury and mid-market segments performing differently, the strategy is segmentation, not one-size-fits-all.

For detailed insights into how the Mumbai real estate market is expected to perform in 2025, including price forecasts and growth drivers, check out our in-depth analysis here:

What Buyers & Investors Should Watch Closely

Credit and lending environments continue to matter.

Micro-market performance varies widely.

Regulatory and urbanization policies shape demand.

Absorption metrics reveal true market health.

Localized infrastructure projects create new opportunity corridors.

Risks That Still Exist

Market uncertainties persist.

Policy shifts might affect approvals.

Global economic shocks could slow investment.

Affordability challenges remain, especially for first-time buyers.

Some sectors (like office space) face structural change pressures — e.g., high vacancy rates in markets like Seattle’s office segment. Axios

This recovery is real — but selective.

Quick Real Estate Market Facts

- India Market Value (2025): ~USD 620 Billion. expertmarketresearch.com

- Price Growth (Selected Cities): ~6–16% YoY. JLL

- U.S. Price Increase (2025): ~1.7% annual rate. Reuters

- Luxury Transactions: Multiple >$100M in 2025. Wall Street Journal

Beyond Headlines: Real-World Impact

From homeownership to rental markets, real estate shapes long-term financial planning and community development. Even cities with slower growth are adapting with tailored strategies — like infrastructure upgrades and targeted incentives.

For insights on why Mohali has become a notable choice for property investors and how reaching the ₹1 crore investment milestone influences local demand, check out our detailed guide here:

Why This Cycle Feels Different

Unlike previous cycles, today’s mix includes moderate price growth, record-high luxury demand, and strong regional leaders alongside localized slowdowns — a structurally nuanced rather than uniformly rising market.

Final Takeaway

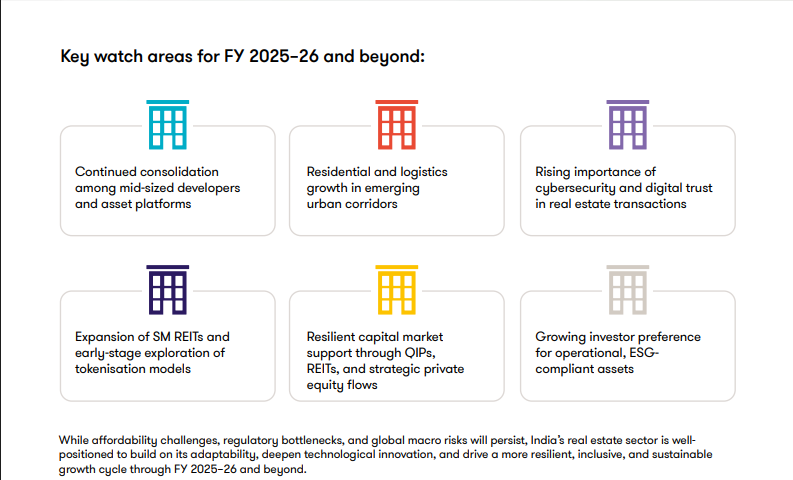

The real estate industry is not just rebounding — it’s realigning. Rather than blanket growth, what we’re seeing is selective strength based on affordability, regional job markets, and demographic shifts.

This is no hype — it’s a structural trend with real data behind it.